Recapitalize your recently completed projects

Refinance your project with a low-cost, fixed-rate, non-recourse PACE loan

PROJECT TYPES

Refinancing with PACE Equity is available for projects that are mid-construction or projects that were completed up to 3 years ago, although the guidelines are unique for each state. PACE Equity can retroactively fund a renovation or new construction project using refinancing. This strategy is especially useful when you are looking for:

- Recapture invested equity to deploy for other projects

- Fund cost-overruns, debt payoffs/paydowns, lease up/debt service reserves, and equity refinancing

- Avoid a capital call or extend your bank maturity

- Create liquidity to redeploy to other needs

Refinancing with PACE Equity

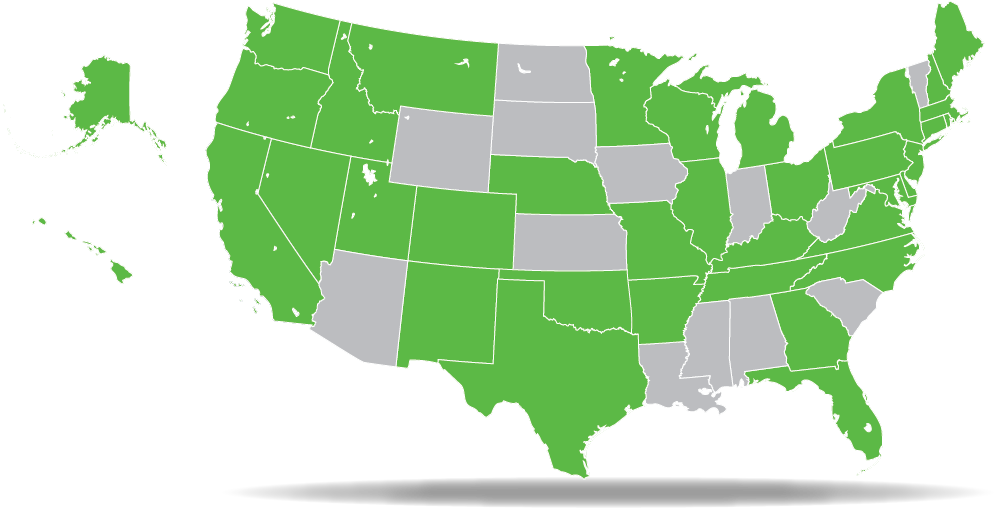

This option leverages your investment in mid-construction work or recently completed development projects or building renovations. You can take advantage of all costs for improvements that impact utility spend (HVAC, lighting, windows, etc.), renewable energy measures, and/or resiliency retrofits (seismic, wind). Each state has unique guidelines that outline the availability of this refinancing option. Ask the PACE Equity Managing Director in your state for details on refinancing.

Projects

Developments

Renovations

Efficiency Upgrades

Use for

Pre-Construction

Mid-Construction

Post-C/O

Flexible Financing for a Luxury Hotel

Our deeply experienced in-house engineering team analyzes building improvements to calculate the maximum funding amount and amortization term. With refinancing, leverage recent building improvements to qualify for funding at rates 50% below mezzanine.