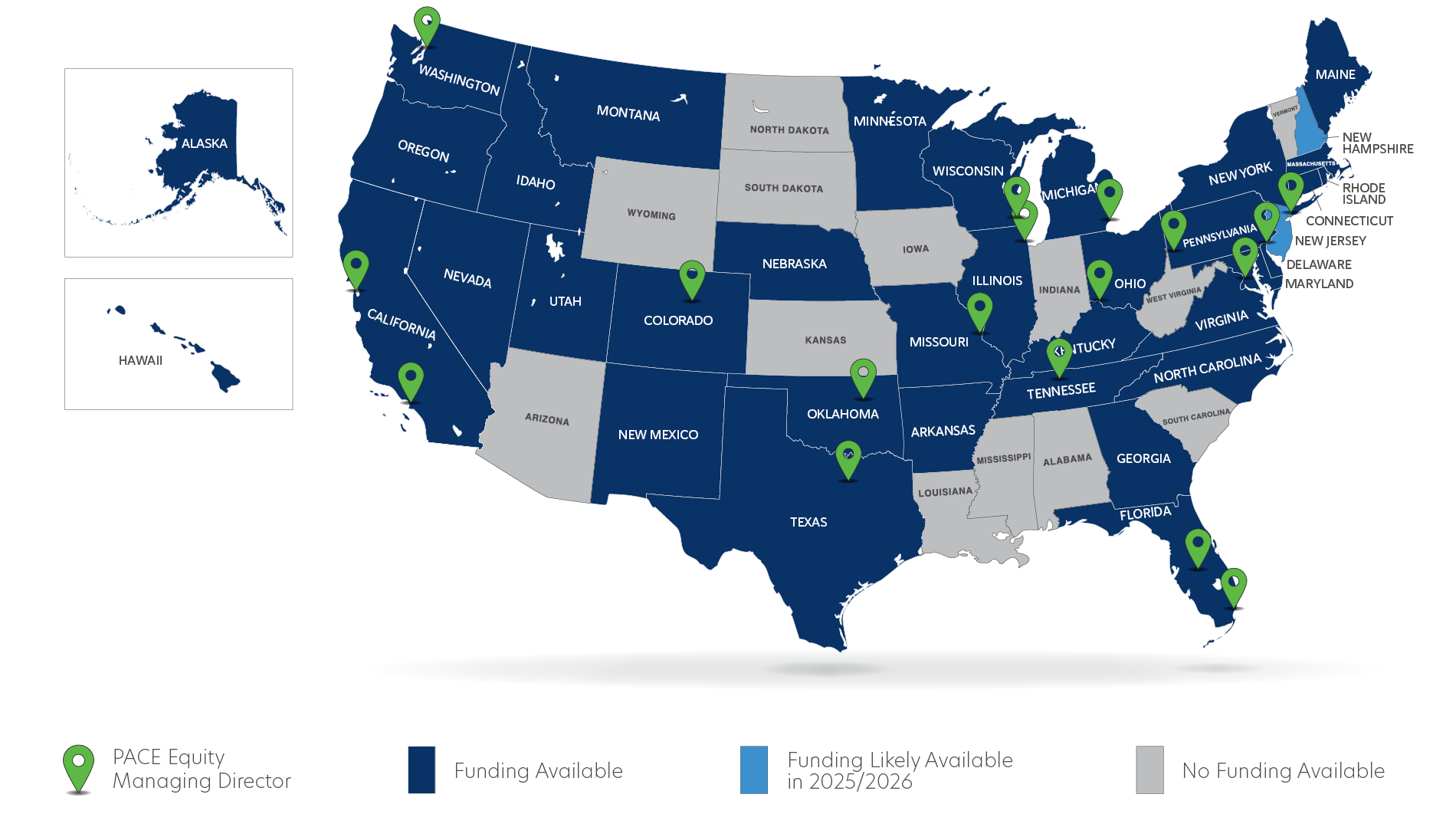

Commercial Property Assessed Clean Energy (C-PACE) financing is available in states and local municipalities after legislation is passed and voluntarily adopted on the community level. By enabling this innovative funding mechanism, governments unlock a strategic, flexible tool for commercial building developers and owners to complete their development budgets, recapitalize existing assets, and invest in energy efficiency and renewable energy upgrades.

The following states have recently adopted C-PACE or seen substantial changes to existing programs.

Georgia: C-PACE financing is available in the city of Atlanta. The local program, Invest Atlanta, has been in place since September 2023 and remains the only operational program in the state. The remainder of Georgia is actively working to adopt C-PACE financing. In April 2024, the Governor signed House Bill 206 into law, allowing for the creation of a statewide program. This program is not yet active.

Idaho: C-PACE financing is available in Idaho. Legislation (H 624) allows for new and existing commercial properties to include energy efficiency, renewable energy, water conservation and resiliency (including energy storage and microgrids).

New Jersey: C-PACE financing is not currently available in New Jersey. The local PACE program, Garden State C-PACE, received approval for its guidelines in October 2024. The state is in the early stages of municipalities opting in to the program.

Prevailing wage is a requirement for all projects participating in the Garden State C-PACE program, including refinancing projects.

New Mexico: C-PACE financing is available in New Mexico. The counties of Bernalillo, Santa Fe, and Taos County as well as the municipalities of Albuquerque, Taos, and Santa Fe have opted into the program.

PACE Equity closed the second ever New Mexico C-PACE Project, Modern Elder Retreat Center, in December 2024.

North Carolina: C-PACE financing is available in North Carolina. New Hanover County became the first municipality to adopt C-PACE financing on February 17th, 2025. The statewide program is administered by the Economic Development Partnership of North Carolina (EDPNC) and the North Carolina Department of Commerce.

Other Legislative Progress

New York: NYSERDA updated PACE guidelines to support new construction in New York City by removing the SIR/CBR requirement for all electric buildings and published an updated CBR methodology to establish an incremental cost approach for meeting it.

As C-PACE expands, it continues to solve financing challenges that developers and owners face in new construction development and renovation projects. Particularly in the coming years as Building Performance Standards prove to be a focus for building owners, more projects will take advantage of the long-term, fixed-rate, non-recourse financing solution that is transferable to future owners when a building is sold.