CIRRUS Financing for Certified Green Buildings

Capital efficiency meets building efficiency

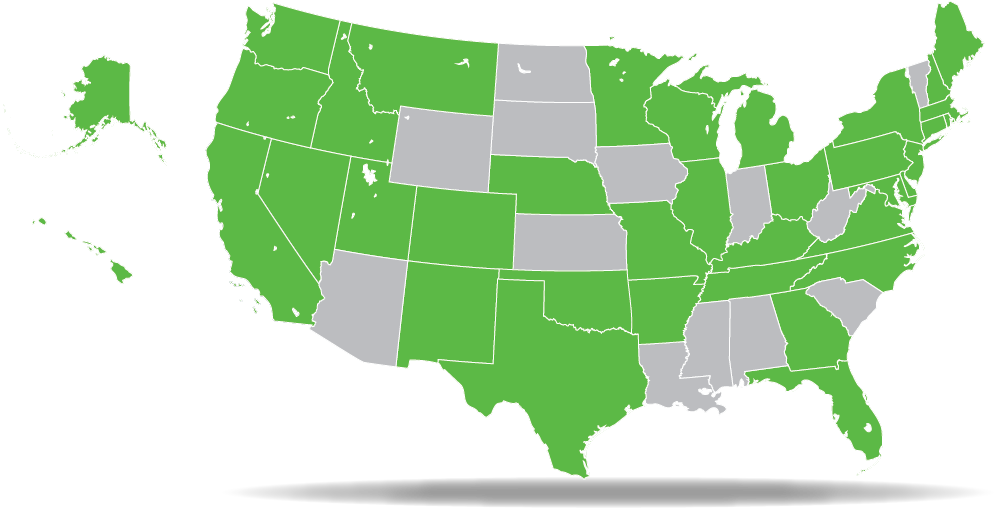

Commercial Property Assessed Clean Energy (C-PACE) is a financing option offering long-term, fixed-rate, non-recourse capital. You can use our private capital for costs which impact energy & water spend, renewable improvements or seismic/resiliency measures. The repayment is made through a long-term special tax assessment on the property, making it transferable upon sale or prepayable at any time.

The CIRRUS C-PACE program from PACE Equity offers the ONLY private capital that improves returns when you build better. Our reduced financing rate rewards building efficiency and carbon impact. Whether you are using one of the 10 most popular green building certifications in the U.S. or our own CIRRUS design specification, you qualify for a substantial rate reduction.

C-PACE Financing Advantages

- Private capital of up to $200 million per project which can be used strategically to optimize capital costs

- Fixed rate/non-recourse capital used for development, renovations, and recapitalization

- Reduce WACC when you replace higher cost options such as mezz and pref equity in the stack

- Use to recapitalize development projects, renovations or recent equipment installations

- Fixed rate capital works alongside HTC, TIF, NMTC, EB5, USDA, OZ, and more

- Repaid through a non-accelerating property tax assessment of up to 30 years

Green Building

Certification

Lower Rate

PACE Equity

Financing

Qualify for a lower

rate when you build a

better building.

Select one of the following green building certifications to learn more about the program and its requirement.

CIRRUS Low Carbon

PACE Equity’s CIRRUS Low Carbon program offers two unique compliance paths, in addition to the Green Building Certification Path.

- Prescriptive Path: Exceed ASHRAE 90.1 – 2019 efficiency standards by 10% or more.

- Performance Path: Demonstrate an 8% reduction in GHG emissions over an ASHRAE 90.1 – 2016 Appendix G energy model.

Leadership in Energy and Environmental Design (LEED)

Projects on the path to Silver certification are eligible for CIRRUS financing rates. Learn more about the LEED certification program.

See LEED’s endorsement of PACE Equity.

To show your engagement with the LEED program and qualify for the CIRRUS financing rate, you must provide the following:

- LEED BD+C: New Construction or LEED O+M: Existing Buildings v4, v4.1 or v5

- Proof of project registration from GBCI.

- Draft scorecard from LEED consultant showing project plan to achieve Silver Certification (or better).

- After construction is complete, submit final GBCI certification showing achievement of Silver Certification (or better).

- Refinance

- Proof of project registration from GBCI.

- GBCI certification showing achievement of Silver Certification (or better).

Green Globes

Projects being certified with a Green Globes certification are eligible for CIRRUS financing rates. Learn more about the GBI Green Globes certification program.

See GBI’s endorsement of PACE Equity.

To show your engagement with the Green Globes program and qualify for the CIRRUS financing rate, you must provide the following:

- New Construction or Renovation

- Proof of project registration from GBI.

- GBI Green Globes Assessor (GGA) report showing project plan to achieve points in each environmental area and plan to achieve a minimum of 55% of total applicable points. This is a PDF version of the online questionnaire indicating which credits are being pursued.

- Refinance

- GBI Green Globes Assessor (GGA) report showing achievement of points in each environmental assessment area (e.g., Energy, Site, etc.)and a minimum of 55% of total applicable points OR Two Green Globes Final Certificate.

Green Globes Journey to Net Zero

Projects that are being certified by the GBI Green Globes Journey to Net Zero are eligible for CIRRUS financing rates. Learn more about GBI’s Green Globes Journey to Net Zero certification.

See GBI’s endorsement of PACE Equity.

To show your engagement with the Journey to Net Zero program and qualify for the CIRRUS financing rate, you must provide the following:

- New Construction or Renovation

- Proof of project registration from GBI.

- GBI’s Green Globes Journey to Zero report for either Energy and/or Carbon as provided by GBI Green Globes Assessor (GGA).

- Refinance

- GBI’s Green Globes Journey to Zero report for either Energy and/ or Carbon as provided by GBI Green Globes Assessor (GGA) OR a certificate from GBI confirming the project’s Recognized status.

HERS Index

Multifamily projects that are being certified by the Resnet HERS Index are eligible for CIRRUS financing rates. Learn more about the HERS rating program.

To show your engagement with the HERS Index program and qualify for the CIRRUS financing rate, you must provide the following:

- New Construction or Renovation

- Projected HERS certificate for each unit type showing an average HERS rating of 55.

- Refinance

- Confirmed HERS Rating Certificate for each unit type showing an average HERS rating of 55.

Zero Energy Ready Home

Projects that are being certified by the Department of Energy ZERH program are eligible for CIRRUS financing rates. Learn more about the ZERH program.

To show your engagement with the ZERH program and qualify for the CIRRUS financing rate, you must provide the following:

- New Construction or Renovation

- For ASHRAE 90.1 and Prescriptive compliance paths: MRO-approved ZERH proposed design submittal (PDS)

- For ERI compliance path: Preliminary energy modeling showing compliance with the ZERH Target ERI score and evidence that the project as planned meets the mandatory requirements described in the Rater Checklists.

- Refinance

- ZERH certificate for each unit OR whole building ZERH certificate.

Passive House Network

Projects that are certified by the Passive House Institute (PHI) are eligible for CIRRUS financing rates. Learn more about the PHI Certification program.

To show your engagement with the Passive House programs (EnerPHit, Passive House Classic, and Low Energy Building) and qualify for the CIRRUS financing rate, you must provide the following:

- New Construction or Renovation

- Evidence of project registration from a PHI-accredited certifier.

- A Passive House verification report from a Certified Passive House Designer or Consultant (CPHD/C).

- A Design Stage Assurance letter from PHI.

- Refinance

- A final certification letter from PHI that you’ve met the Passive House, Low Energy Building, or EnerPHit requirements.

PHIUS

Projects that are being certified by Phius are eligible for CIRRUS financing rates. Learn more about the Phius certification programs.

See Phius’ endorsement of PACE Equity.

To show your engagement with the Passive House program and qualify for the CIRRUS financing rate, you must provide the following:

- New Construction or Renovation

- Evidence of project registration from Phius for Phius CORE or Phius RENEW

- A Phius verification report from a Certified Passive House Consultant (CPHC)

- A design certification letter from Phius

- Refinance

- A final certification document from Phius that you’ve met the CORE or RENEW requirements.

Living Building Challenge

Projects that are being certified by the Living Future Institute are eligible for CIRRUS financing rates. Learn more about Living Building Challenge certification.

To show your engagement with the Living Building Challenge certification program and qualify for the CIRRUS financing rate, you must provide the following:

- New Construction or Renovation

- Proof of project registration for the Living Building Challenge.

- Ready Audit report for the Living Building Challenge.

- Refinance

- Proof of project registration for the Living Building Challenge.

- Final Audit (Certification) report for the Living Building Challenge.

Other Certification Programs

Other green building programs may be eligible for our CIRRUS financing rate such as the Florida Green Building Coalition, EarthCraft, NYStretch, or similar.

Talk to your local Managing Director to learn more.

CIRRUS C-PACE Financing

- Substantial rate reduction from PACE Equity

- Experienced engineering team: our in-house team assists your design team meet the efficiency goals at the lowest costs

- Many ways to qualify: LEED Silver, Green Globes, HERS Rating, and more; plus our own design specification