A Little History About Historic Tax Credits

For more than three decades, the federal government has had a hand in the preservation of U.S. historic resources. In 2000, the National Trust for Historic Preservation created the National Trust Community Investment Corporation (NTCIC) to support the historic preservation movement through direct investments. The organization supports the country’s architectural heritage through the provision and investment of Federal and State Historic Tax Credits.

How do Historic Tax Credits Work?

Historic tax credits provide a tax incentive to rehabilitate historic buildings. The credit equals 20 percent of qualified rehabilitation expenses and is allocated during a five-year period on a federal income tax return. The 20 percent credit applies only to certified historic structures including buildings that are listed individually on the National Register of Historic Places or contribute to the significance of National Register Historic Districts. The building must be used for business or other income-producing purposes.

How Does C-PACE Fit with Historic Properties?

Commercial Property Assessed Clean Energy (C-PACE) from PACE Equity is private capital that can be used along with HTCs in a capital stack. While C-PACE can be used for new construction, it can be used to fund 100% of the eligible costs for renovations or redevelopments of historic buildings.

PACE Equity also offers CIRRUS Low Carbon: a unique funding program that provides a significant rate reduction for more efficient, lower carbon buildings. This is a perfect fit with HTCs as you make selections of equipment and other efficiency measures that will impact the long-term operating costs of the building. (CIRRUS also has exceptions for important historic elements such as windows.)

PACE Equity financing is uniquely positioned to work with complex capital stacks, which is particularly important with historic properties. Using PACE Equity’s capital, owners and developers are able to close funding gaps or add/replace more expensive capital while generating better returns for historic properties.

Historic Tax Credit Properties Using PACE Equity Funding

Gulfstream Hotel/Lake Worth Marriott in Lake Worth Beach, FL

The historic Gulfstream Hotel was constructed in 1925 and added to the National Register of Historic Places in 1983, and was transformed to its original glory in the form of a 90-room Marriott resort hotel along the Atlantic Ocean. PACE Equity provided low-cost, non-recourse, fixed-rate financing, filling a 27 percent gap in the capital stack. Even more, the developer qualified for the lowest possible rate with the CIRRUS Low Carbon program. The in-house Low Carbon Team at PACE Equity helped with suggestions for optimizing the efficiency while taking into account the unique limitations of the property.

Coliseum Building, Minneapolis

This downtown Minneapolis office building, originally constructed in 1917, underwent a redevelopment funded with a complex capital stack including Historic Tax Credits, New Market Tax Credits, multiple grants and other financing options. These funding vehicles paired well with the final piece in the capital stack, PACE Equity funding, enabling the project to go forward, and also leveraged updated efficiency measures to qualify for CIRRUS Low Carbon financing.

Hear what the developer had to say.

Hotel Petersburg

The circa 1916 Hotel Petersburg in Richmond, VA was vacant for decades but a developer turned the building into a 64-key boutique hotel, including restoration of many of its historic features. The Hotel Petersburg was the first C-PACE hotel development project in Virginia and the first C-PACE project in the greater Richmond area. PACE Equity provided bridge financing until additional funding was disbursed via federal and state tax credits.

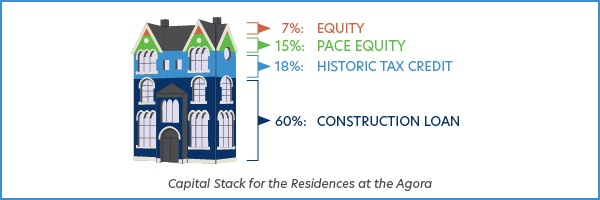

Residences at the Agora

The historic Agora Theater was a redevelopment project featuring office space, 48 apartment units and a street-facing restaurant located along the high-growth Cleveland Healthtech Corridor. The development is the nation’s first CIRRUS Low Carbon project, meeting efficiency requirements to qualify for low financing rates.

While historic redevelopment can be challenging, these projects and others we have funded show that our proven process can help you fill a funding gap with PACE Equity or CIRRUS Low Carbon financing. We welcome complex capital stacks. In fact, complex is our comfort zone.

Let’s get started.