A Developer Strategy for Funding Building Performance Standards

THE BUSINESS OF DEVELOPING & RENOVATING BUILDINGS

U.S. commercial buildings account for nearly 40 percent of energy consumed and more than 30 percent of greenhouse gas emissions and can be a source of much higher emissions in cities (US Department of Energy). As we see the results of climate change in rising sea levels, escalating ocean temperatures, extreme heat, and unchecked wildfires, policymakers are responding. They are establishing climate commitments which require carbon reduction goals be met and establishing incentives to encourage low carbon behaviors. Reducing emissions from existing buildings is a critical pathway to address decarbonization goals and climate change.

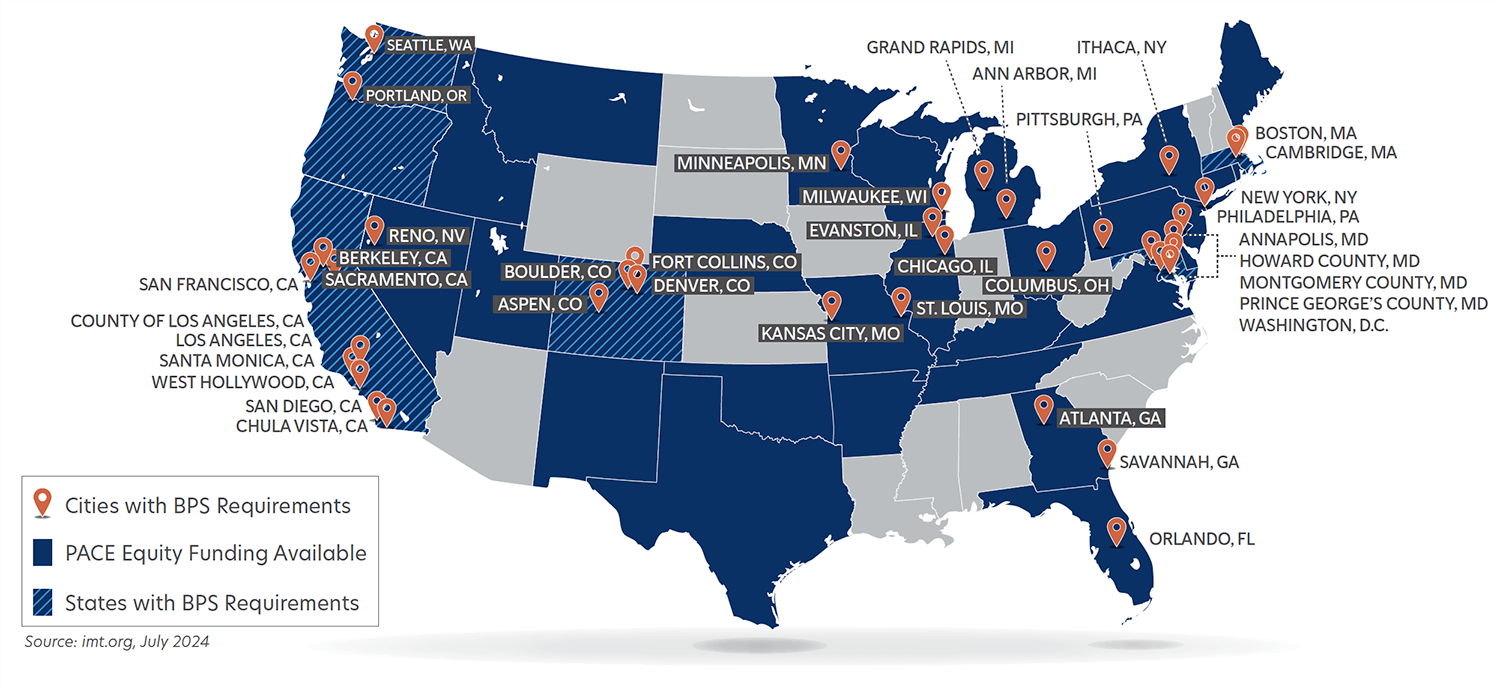

Over 50 U.S. cities and 6 states have implemented Building Performance Standards (BPS) for 2030 and 2050. Building owners must move to action so they can meet the 2030 goal requirements.

One tool policymakers are employing is the implementation of local Building Performance Standards—building efficiency requirements defined with Energy Use Intensity (EUI) Limits met by a specified deadline. As of this writing, over 50 U.S. cities and six states have implemented Building Performance Standards (BPS). Most BPS are written with initial EUI goals (by building type) with deadlines by 2030, and steeper EUI goals for 2050. Building owners must move to action so they can meet the 2030 goal requirements.

A low-carbon future features better buildings in which to live and work:

- Existing buildings are renovated to incorporate more efficient technologies and equipment, resulting in lower operating carbon.

- New developments are designed for high efficiency and use low-carbon materials, reducing both operating and embodied carbon.

- The construction work associated with reducing carbon emissions are supporting local economies and creating local jobs.

An important question that hasn’t been answered within the policies is how to fund the required standards. This paper is geared to property owners who want to learn the basics of Building Performance Standards and answer the question of how to fund the required renovations. You’ll find the basics of how BPS work, how they can make a difference in new and existing buildings, how you can pay for them, and what you need to do to get started.

CHAPTER ONE:

What are Building Performance Standards (BPS)?

Local Governments Target Buildings to Meet Climate Goals

Building Performance Standards are outcome-based policies and laws aimed at reducing the negative carbon impact of the built environment. These policies ensure reduced energy use (which results in reduced carbon emissions) in commercial buildings. The carbon emission reduction is accomplished by improving the efficiency of systems that use electricity and fossil fuels.

When combined with state building codes that regulate efficiency and components that ensure healthy indoor environments for new construction or renovations, BPS become powerful policy tools that address building performance throughout their lifecycles. BPS are designed to meet specific, measurable emission goals. The standards become stricter over time, driving continuous, long-term improvement in the local building stock.

By requiring buildings to meet a specified level of performance, a BPS can establish long-term certainty. This is the mechanism that local governments are using to actualize climate goals.

BPS policies establish specific performance levels by building type along with deadlines for building owners. This is the mechanism that local governments are using to actualize climate goals. Most BPS requirements based on the Energy Use Intensity metric (EUI). Energy Use Intensity measures a facility’s energy performance on a per square foot basis. It’s calculated by dividing the total amount of energy a building consumes in a year by its total gross floor area. The energy is typically measured in kilowatt hours (kWh) of electricity or therms of natural gas, but it’s converted to a common unit of measurement, such as British thermal units (BTU) or gigajoules (GJ), before calculating EUI. The most common formula for calculating EUI is kBtu/square foot/year.

Energy Use Intensity (EUI) = Thousands of British Thermal Units Used Per Square Foot per Year (kBtu/sq. ft./year)

While all BPS share similar central components in design and implementation, the standards are generally customized for each jurisdiction and community for maximum impact and benefit. Successfully developing and delivering these standards necessitates collaboration between local policymakers, landlords, tenants, operators, architects, and engineers.

Across the United States, states and cities have established long-term commitments to reduce greenhouse gas (GHG) emissions, with some goals focused on reducing emissions by up to 50% by 2030 and by up to 90 percent by 2050. By requiring buildings to meet a specified level of performance, a BPS can establish long-term certainty, helping building owners plan for upgrades to improve buildings, stimulate the local economy, and create jobs. For example, the BPS in New York City is estimated to create a $20 billion retrofit market, which would make it the largest in the country, and lead to the creation of more than 140,000 jobs by 2030.1

CHAPTER TWO:

Benefits of Improved Performance

High-Performing Buildings are Good for Your Bottom Line

Building Performance Standards are designed to improve performance for a variety of building systems, primarily those that use electricity and fossil fuels. One impact of these improvements will be realized when rental rates hold or escalate, and more tenants find value in improved spaces. Tenants want to live in efficient buildings. Studies show that efficient buildings have occupancy rates 3 – 7 percent higher than their less efficient counterparts. (www.rmi.org) Once BPS requirements are met, a building is more valuable. The Net Operating Income is improved since energy costs are reduced, resulting in improved property valuation. A potential buyer doesn’t have to add the cost of upgrades to the consideration of whether to buy and manage the property. The improved building may be able to take advantage of utility rebates, local incentives, or federal tax deductions or credits. If you plan to finance upgrades, you can leverage C-PACE financing, and take advantage of a program through PACE Equity that offers lower financing rates when you finance a more efficient building. This will boost your Internal Rate of Return and deliver financing benefits with fixed-rate, long-term, non-recourse funding. Average amortization terms are between 20 and 30 years since they reflect the average expected life cycle of the building systems being upgraded.

Benefits of Renovated Buildings:

Access to lower financing rates for efficient building

Higher occupancy rates

Increased NOI

Improved property value

Access to incentives / rebates / tax credits

CHAPTER THREE:

Funding BPS Upgrades

C-PACE Financing Saves Money for You and Thousands of Metric Tons of Carbon for the Planet

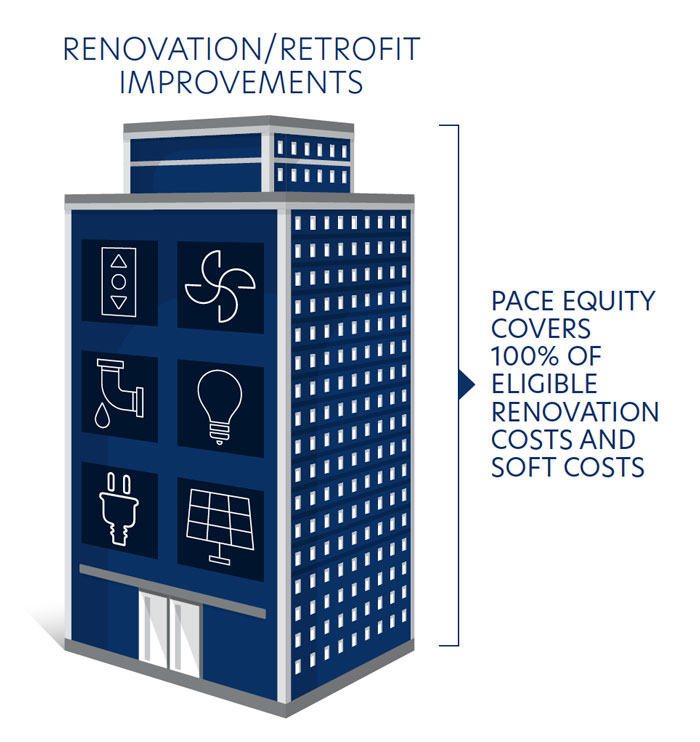

Property owners who are planning renovations to meet BPS requirements are asking about funding options. Meeting BPS requirements will mean investing in energy efficient equipment and appliances, clean energy technologies, and even renewable energy. Many communities are pushing building owners to electrification, avoiding the use of fossil fuels entirely. The required upgrades may not be in the current operating or capital budget.

C-PACE financing is a tool that funds energy efficiency, resiliency, and renewable energy improvements for commercial properties. It is currently available in 40 states as a means to encourage efficiency investments with lower costs from private capital sources, and repayments made via a special tax assessment on the property and paid in sync with local property tax schedules. When pursuing a renovation project, the entire budget is often made up of C-PACE eligible measures (windows, HVAC, elevators, roof, water heating, etc.) which can be funded entirely with the long-term, lower cost capital. Properties of all types including multifamily, office, industrial, hospitality and senior living can access this capital (buildings that are required to pay property taxes). If the assessment is still on the property when you are ready to sell it, the assessment can be transferred to the new owner.

PACE Equity offers CIRRUS financing which is C-PACE financing with a significantly lower financing rate plus a green building certification. The CIRRUS financing is a strong candidate to fund BPS upgrades since the lower rates are provided to property owners who meet a more efficient design specification. For property owners faced with a renovation project, this low cost and flexible option may be the solution

Significantly Lower Financing Rate

Green Building Certification

CHAPTER FOUR:

Earning Lower Financing Rates for Reduced Carbon Buildings

CIRRUS™ Low Carbon and CIRRUS Zero Carbon Offer Significantly Lower Rates

PACE Equity’s CIRRUS program offers the only private financial capital that offers lower rates when your renovation meets a straightforward and practical lower carbon or net zero design specification. The Design Guidance offered by the PACE Equity Low Carbon Center of Excellence is a no cost addition for clients to ensure they qualify for the lower rates. The Low Carbon Team evaluates the design details and outlines if changes need to be made and the costs that will be incurred. The good news is that the lower financing rates are so significant that any incremental costs (on average 0.20% of the hard cost budget) are covered, leaving remaining financial benefits that deliver a strong return on investment. Said another way, any incremental costs to meet the design requirements are outweighed by the financial benefits by an average ratio of 13:1 (financial benefits to incremental costs).

13:1

Ratio of financial benefits compared to incremental costs to meet required efficiency.

CIRRUS™ Low Carbon and CIRRUS Zero Carbon Offer Significantly Lower Rates

With these savings in mind, CIRRUS can be a fit for your next renovation project. PACE Equity funds, using either standard financing or CIRRUS financing, can cover 100% of eligible renovation costs and corresponding soft costs.

- Use the energy and maintenance savings you realize from renovations to help pay off your PACE Equity financing.

- Tackle your deferred maintenance backlog.

- Use PACE Equity funding to install or upgrade efficient business process equipment, such as better refrigerants in cold storage facilities or renewable energy for energy-intensive manufacturing plants.

- Improve your building with efficiency upgrades and resiliency improvements. When you use PACE Equity, you can tie Common Area Maintenance (CAM) charges and green building fees to loan repayments.

CHAPTER FIVE:

BPS Upgrades That Qualify for C-PACE Financing

Most BPS Projects Fit into the C-PACE Wheelhouse

PACE Equity provides BPS financing for major renovations, redevelopments, rehabs, retrofits, and renewable energy projects. The required renovations won’t just meet local BPS requirements, they can result in improved occupancy rates and higher property values plus improved operating incomes due to lower energy and maintenance costs. With the CIRRUS program from PACE Equity, you’ll get all of these benefits along with a substantial reduction in financing rate, delivering a business case that makes good financial sense.

A recently renovated project is also eligible for PACE Equity funding through refinancing. This option is available for projects that are mid-construction or those completed up to three years ago, although the guidelines are unique to each state.

Low-Cost, Long-Term, Fixed-Rate, Non-Recourse Funding

Reduced Energy & Maintenance Costs

Higher Operating Income

Improved Occupancy Rates

Higher Property Values

CHAPTER SIX:

Summary and Getting Started

Building Performance Standards are currently implemented in over fifty U.S. cities and six states, and the trend to require property owners to improve buildings is expected to continue. Using Energy Use Intensity as a primary metric (or sometimes Greenhouse Gas Emission calculations), cities are asking building owners to renovate their existing building stock to bring down carbon emissions. While cities are developing BPS, they are not providing a funding solution.

C-PACE financing from PACE Equity is a financially beneficial way to improve the efficiency and resiliency of a building, while making the building more valuable and driving down operating costs. CIRRUS financing from PACE Equity offers a substantial rate reduction when a building is designed for (1) Low Carbon with slightly better efficiency than most state building codes or (2) Net Zero with an all-electric building (some exceptions apply) and renewable energy.

CHAPTER SEVEN:

Map

View the map of National Building Performance Standards Coalition’s participating municipalities.

CHAPTER EIGHT:

Details on Enacted Programs

Washington:

Clean Buildings Performance Standard: Washington enacted HB 1257 in 2019, mandating energy performance standards for government, multifamily, and commercial buildings of a certain size. The goal is to reduce building emissions by 95% by 2050. Buildings must meet specific Energy Use Intensity (EUI) targets based on building type and occupancy. The initial EUI target is set at 15% below the average EUI for the building type, with future targets to come.

Seattle, Washington:

Building Emissions Performance Standards: Seattle enacted building emissions performance standards in 2023, mandating emissions reductions for public, government, commercial, and multifamily buildings of a certain size. The goal is to reduce building emissions by 27% by 2050. Buildings must meet specific Greenhouse Gas Emissions Intensity (GHGIT) targets, measured in kgCO2e/SF/yr, based on building activity type.

Oregon:

Energy Performance Standards: Oregon enacted HB 3409 in 2023, mandating energy performance standards for public, government, multifamily, and commercial buildings of a certain size. The goal is to reduce energy use by 45% by 2035 and 80% by 2050. Specific performance metrics and standards are currently under development.

Chula Vista, California:

Building Energy Savings: Chula Vista enacted Ordinance 3498 in 2021, mandating significant energy efficiency improvements for large public, government, multifamily, commercial, and industrial buildings. The goal is to reduce energy use by 57% by 2030 and achieve net-zero by 2045. Specific performance metrics and standards vary based on property type but generally involve ENERGY STAR scores or Weather-Normalized Site EUI.

Colorado:

Energy Performance for Buildings: Colorado enacted HB 21-1286 in 2021, requiring energy performance standards for commercial, multifamily, and public buildings of a certain size. The state aims to reduce emissions by 7% by 2026 and 20% by 2030 compared to 2021 levels. Performance will be measured using Site EUI or GHGI, with specific Site EUI targets set for different property types.

Denver, Colorado:

Energize Denver: Denver enacted Bill 21-1310 in 2021, known as Energize Denver, to significantly reduce greenhouse gas emissions and energy consumption in commercial and multifamily buildings of a certain size. The city aims to reduce GHG emissions by 80% by 2040, decrease building energy use intensity by 30% by 2030, and achieve net-zero energy by 2040. To track progress, the city will measure the weather-normalized site energy use intensity (EUI) of each covered building. By 2030, each building must meet a maximum site EUI standard based on its occupancy type. Interim performance targets in 2024 and 2027 will ensure steady progress towards the final goal.

St Louis, Missouri:

Building Energy Performance Standards: St. Louis enacted Ordinance 71132 in 2020, implementing Building Energy Performance Standards for municipal and privately-owned commercial and residential buildings of a certain size. The goal is to reduce greenhouse gas emissions 100% by 2050. Performance will be measured by site energy use intensity (EUI). The city will set standards at the 65th percentile for each property type, ensuring that at least 65% of buildings in that category have a higher EUI. The Office of Building Performance will update these standards at the end of each compliance cycle.

Maryland:

Climate Solutions Now Act: Maryland enacted the Climate Solutions Now Act (SB 528) in 2022. This legislation mandates energy performance standards for commercial, institutional, multifamily, and municipal buildings of a certain size. The state aims to reduce emissions by 60% by 2031 and achieve net-zero emissions by 2045. Performance will be measured by net direct emissions standards (kg CO2e per square foot) for interim standards and Site EUI Standards (kBtu per square foot) for the final standard. Existing buildings over 35,000 square feet must achieve a 20% reduction in net direct greenhouse gas emissions by 2030 compared to 2025 levels and net-zero direct greenhouse gas emissions by 2040.

Boston, Massachusetts:

Building Emissions Reduction and Disclosure Ordinance: Boston enacted the Building Emissions Reduction and Disclosure Ordinance (Chp.VII, Sec 7-2.1 & 7-2.2) in 2021, requiring all public, government, commercial, multifamily, and residential buildings of a certain size to reduce greenhouse gas emissions. The city aims to reduce emissions by 50% by 2030 and achieve net-zero emissions by 2050. Performance is measured by annual greenhouse gas (GHG) emissions (kgCO2e/sq. ft./year). Building targets are set by building type on an emissions intensity basis, and buildings must meet these targets annually starting in 2025, with increasing stringency every five years. Building owners can apply for individual compliance schedules to achieve the 50% and 100% reduction goals using a 2005 or later baseline.

New York City, New York:

Local Law 97 (LL97): New York City enacted Local Law 97, also known as Sustainable Buildings NYC, in 2019. This law targets large commercial and multifamily buildings, aiming to reduce carbon emissions by 40% by 2030 and 80% by 2050. Performance is measured by annual greenhouse gas (GHG) emissions (tCO2e/sq. ft.). Building emission limits are calculated based on building type and gross floor area. GHG emissions are determined by multiplying the energy consumption of each fuel type by its corresponding GHG coefficient. Targets are updated every five years to progressively reduce emissions.

Washington DC:

Building Energy Performance Standards and Benchmarking: Washington D.C. enacted Building Energy Performance Standards and Benchmarking (D.C. Law 22-257) in 2018. This law targets public, government, commercial, and multifamily buildings of a certain size. The goal is to reduce emissions by 45% by 2030 and 95% by 2050. Performance is measured by the ENERGY STAR score or source EUI for ineligible buildings. The law directs the Department of Energy & Environment to assess an emissions-based metric by 2023. Building energy performance standards are set at the district median ENERGY STAR score for each property type. The District Department of Energy & Environment (DOEE) will issue new performance standards every six years. The law directs DOEE to set campus-wide standards for educational campuses a