PACE Equity Offers Funding at Construction, at CO and Up to 3 Years After Construction

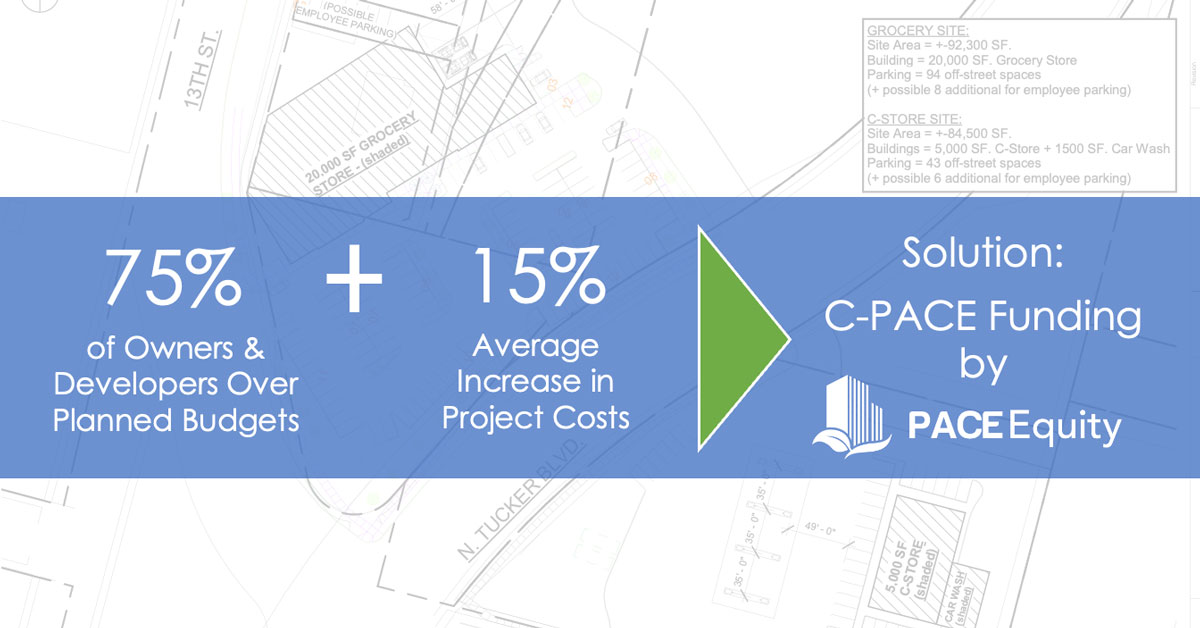

About 75% of owners and developers of commercial real estate projects are over planned budgets, based on a survey done in May and June (2021) by research firm IDC. A large majority of North American construction projects are being delivered late and significantly over budget compared to the owners’ original plans.

The survey found that not only are 75% of owners over planned budgets on their CRE projects, but 77% were late. For each development project, owners experienced a 15% average increase in project costs.

The good news is that funding is available to cover these funding challenges. Our Fast Track™ Funding process, leveraging our own engineering team, can nimbly address funding challenges for project construction, mid-construction or refinancing — for new construction, renovation or redevelopment projects.

Cost Escalation Due to Lumber Costs: Like many projects today, this multifamily new construction project faced a substantial budget increase due to lumber costs increasing prior to closing their construction financing. The bank did not increase their funding, so the developer requested expanded funding from PACE Equity. We rapidly reconfigured all elements of the engineering and funding calculations to accommodate the increased funding need.

Cost Overruns during Construction: This senior housing redevelopment project faced delayed construction and cost overruns due to Covid. PACE Equity was brought in to cover the cost overruns and replenish the operating reserve so the property could open and begin lease up. This avoided a capital call by the sponsors.

Are you facing cost escalations, overruns or other funding challenges? Ask your local Managing Director how you can manage unplanned costs on your project. Accomplish more with PACE Equity.