Decarbonization is advancing like never before. If you are a building owner or a building developer, you should be thinking about decarbonizing your building stock. You may call it “renovations”, “retrofits”, or “upgrades,” but the result is the same. You are making the building more energy and water-efficient which results in reduced carbon emissions. You are making your building more appealing to tenants and more cost-effective to run.

As climate impacts intensify and the reality of climate change is felt more significantly, the real estate industry faces pressure to adopt sustainable building practices.

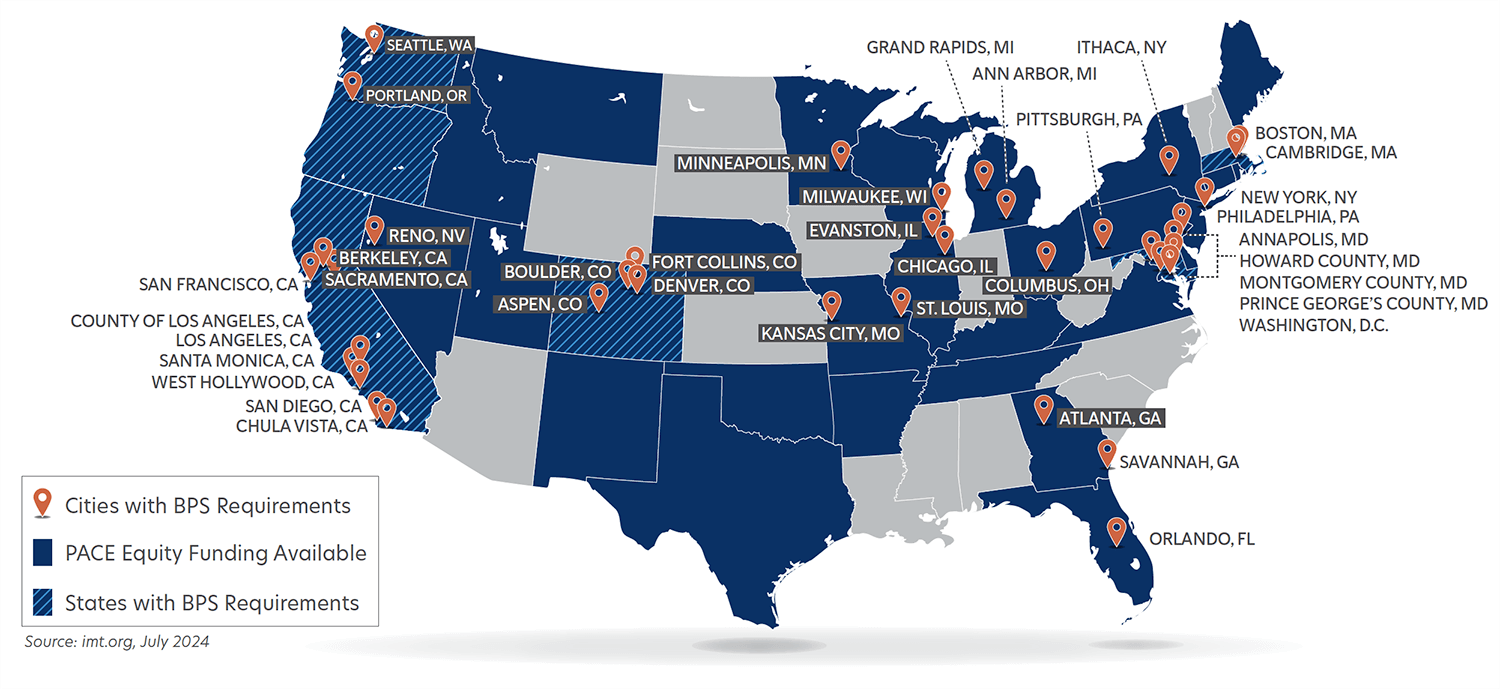

Local and state initiatives are leading the charge to improve the built environment and protect real estate investments while they address climate change concerns. These are in the form of Building Performance Standards (BPS) – regulations limiting carbon emission reductions in the existing building stock. Six states and 50 cities have committed to creating these region-specific carbon emission reduction requirements.

For decades, building owners and developers have been deciding between eco-friendly and cost-friendly. The cost of high-performance systems and sustainable materials was a deterrent to building more efficient buildings.

The price of green building materials and high-performance building technologies continues to decline as they move along the product maturity lifecycle. Financing solutions that fund buildings that use efficient materials and technologies come with reduced rates to offer financial motivation. Specifically, CIRRUS financing from PACE Equity offers reduced financing rates using C-PACE financing for both new construction and renovation projects. C-PACE gives building owners access to low-interest loans that have 20 to 30-year terms with fixed rates. They have the added benefit of being non-recourse and flexible; they work with a variety of funding sources (like TIF, HTC, NMTC, etc.) and can fund up to 30% of a new construction project and 100% of a renovation project.

>

Building Better: From Conceptual to Concrete

Green building has evolved quickly from the work of a passionate few to an industry-wide movement being driven by climate change and the adaptations of state and local governments to improve building codes and demand more from building owners. The new BPS requirements deliver to the expectations of increasingly sustainability-oriented tenants and investors.

Office building owners use beautiful and sustainable spaces to entice tenants, who in turn use the spaces to recruit strong talent.

Apartment building owners promote energy efficiency to appeal to tenants searching for better indoor air quality and lower utility costs.

The sustainability shift isn’t just good for positively affecting climate change; it’s also good for business, with greener buildings consistently achieving higher occupancy rates and increased long-term market appeal.

C-PACE + CIRRUS: Impacting Project Financials

One of the most effective tools to make green building more accessible is Commercial Property Assessed Clean Energy (C-PACE) financing. C-PACE offers low-interest loans specifically for property upgrades that increase energy efficiency and resiliency. C-PACE is available for renovations and new construction and can be used in the capital stack to replace more expensive funding options such as mezzanine loans or outside equity.

The advantage of C-PACE financing is its low-cost and fixed-rate structure — the loan is long-term (typically between 20 and 30 years) and is repaid through an assessment on a property tax bill. C-PACE provides unique advantages for developers that traditional lending paths aren’t able to achieve, such as its low costs and transferability between owners. The impact of green building financed through C-PACE is also substantial. Beyond energy savings, the program leads to carbon reductions from more efficient buildings which in turn benefits the environment and funds required building renovations from BPS.

PACE Equity’s CIRRUS program provides all of the benefits of C-PACE and enhances them with a substantial rate reduction when the building meets CIRRUS requirements. If a developer is already planning to pursue a green building certification, such as LEED, they are automatically eligible for the rate reduction through one of the CIRRUS financing compliance paths.

The Time is Now

As the market for green building grows, C-PACE financing is a key component and strategic advantage to meeting sustainability goals while also building the long-term value of a property. CIRRUS financing by PACE Equity uses C-PACE as a powerful tool for making a lasting impact on the environment and the developer’s bottom line. Sustainability and profitability go hand in hand.